Imagine this — you’ve just opened your first trading app. The interface looks exciting but a little scary. You see options like Zerodha, Upstox, and Angel One, but someone else says, “Use a full-time broker—they’ll guide you.” You pause and wonder: what’s the real difference between discount broker and full-time broker, and which is better for you?

If you’ve been stuck in this confusion, you’re not alone. Every Indian beginner faces this question. This guide will help you understand both options clearly — how they work, what they charge, and how to decide what’s best for you.

Core Concept Explained (Simple Language)

Let’s start with a simple idea:

Both discount brokers and full-time brokers help you buy and sell stocks in India — but they serve different types of investors.

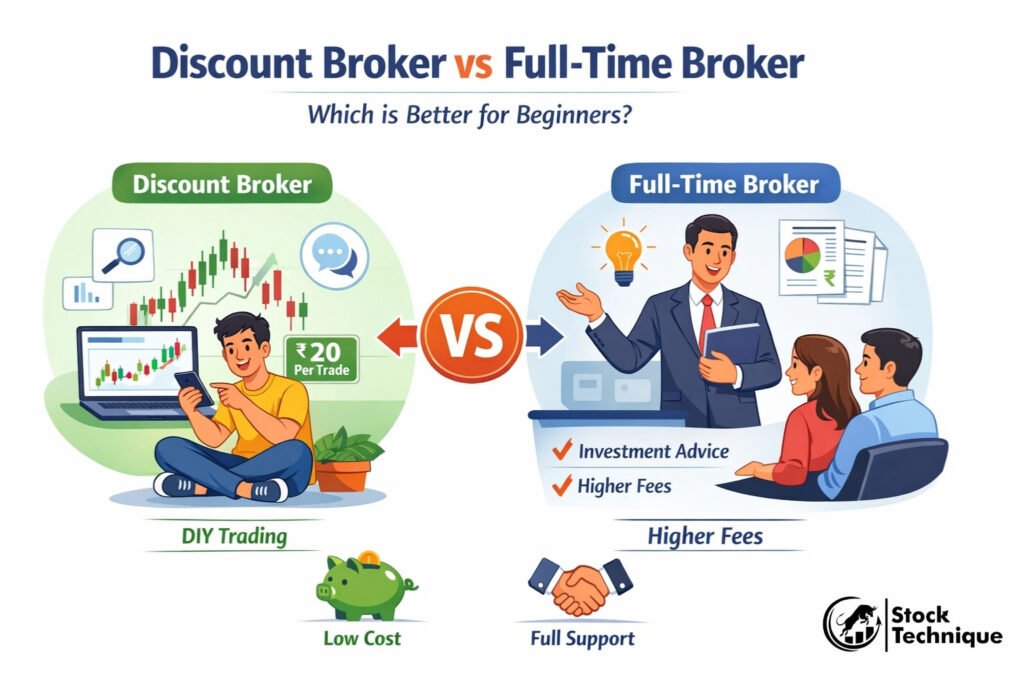

What is a Discount Broker in India?

A discount broker is like a self-service stock market app. You handle your trades, and they simply provide the platform.

They don’t give you stock tips, research, or personal advice. In return, they charge very little — often ₹20 or less per trade.

Examples: Zerodha, Groww, Upstox.

These brokers are perfect for young investors who prefer doing research themselves.

What is a Full-Time Broker (Full-Service Broker)?

A full-time broker, also known as a full-service broker, is like a financial guide. They not only execute your trades but also give investment advice, portfolio management, and research reports.

Examples: ICICI Direct, HDFC Securities, Kotak Securities.

They are ideal for people who want expert support and personal assistance.

How It Works (Step-by-Step)

1. Account Opening

-

Discount Broker: You can open a Demat and trading account online in minutes using Aadhaar and PAN.

-

Full-Time Broker: Often requires more paperwork and in-person or video verification.

2. Brokerage Charges

-

Discount Broker: Flat fees — around ₹20 per trade (or sometimes free for delivery).

-

Full-Time Broker: Percentage-based — around 0.3% to 0.5% of your trade value.

3. Services Provided

-

Discount Broker: Trading platform, charts, and basic tools.

-

Full-Time Broker: Research reports, portfolio tracking, wealth management advice.

4. Support Level

-

Discount Broker: Mostly chat or email support.

-

Full-Time Broker: Dedicated relationship managers or branch-level support.

5. Best For

-

Discount Broker: Independent learners and cost-conscious traders.

-

Full-Time Broker: Busy professionals and people who prefer handholding.

Important Terms Beginners Should Know

-

Trading Account: Used to buy/sell shares on NSE or BSE.

-

Demat Account: Used to store shares electronically.

-

Brokerage: The fee brokers charge per transaction.

-

Intraday Trading: Buying and selling on the same day.

-

Delivery Trading: Buying and holding shares for longer periods.

-

Call and Trade: A service where you can place orders by phone.

-

Margin: Borrowed money from the broker to buy more shares.

Simple Comparison Table

| Feature | Discount Broker | Full-Time Broker |

|---|---|---|

| Account Opening | Fully online | Online + Offline |

| Brokerage Charges | ₹20 or less per trade | 0.3% – 0.5% of trade value |

| Advisory Services | Not available | Personal guidance |

| Tools & Research | Basic charts | In-depth reports |

| Support | Chat/email | Relationship manager |

| Best For | Self-learners & traders | Busy professionals & investors |

Common Beginner Mistakes

-

Choosing only by popularity: Many beginners go for a broker just because their friends use it, not understanding their needs.

-

Ignoring brokerage charges: Even small fees add up — a ₹20 fee per trade feels cheap but adds up with frequent trades.

-

Expecting advice from a discount broker: Remember, apps like Groww or Zerodha don’t guide you; they only execute your trades.

-

Over-trading: Beginners often trade too much without understanding risks, losing money quickly.

-

Skipping education: Jumping into the market without learning basic terms like Demat or brokerage leads to confusion.

Practical Advice for Beginners

-

✅ Start small: Even ₹500–₹1000 is enough to practice buying stocks.

-

📚 Learn before you trade: Understand how brokers charge commission in India before investing big amounts.

-

⚖️ Compare before choosing: Check the pros and cons of discount brokers online and see if they suit your learning style.

-

🚫 Avoid paid stock tips: Reliable brokers never guarantee profits.

-

💡 Use free learning resources: Visit Stock Technique Courses to learn the basics in a beginner-friendly way.

Frequently Asked Questions

1. What’s the main difference between discount broker and full-time broker?

A discount broker offers low-cost trading with no advice, while a full-time broker provides guidance and research but at a higher cost.

2. Who should choose a discount broker?

If you’re confident doing your own research and want to save on fees, a discount broker like Zerodha or Upstox is ideal.

3. Who should choose a full-time broker?

If you want personal support and portfolio guidance, a full-time broker such as ICICI Direct is a better fit.

4. How do brokers charge commission in India?

Discount brokers charge a flat fee (like ₹20 per order), while full-time brokers take a percentage of your trade value (0.3%–0.5%).

5. What is the difference between trading account and Demat account?

A trading account is for buying/selling shares, while a Demat account holds your shares safely in electronic form.

Conclusion

Choosing between a discount and full-time broker isn’t about which is “better” — it’s about what fits your style.

If you’re an independent learner who enjoys low fees, go for a discount broker. If you want guidance and full support, a full-time broker will be worth the cost.

Understanding the difference between discount broker and full-time broker helps you make smarter, calmer investment decisions.

And remember — no matter which you choose, always learn before you earn. Start your learning journey today with Stock Technique Courses.