You apply for an IPO with ₹1,000. Money gets blocked. Days pass.

Suddenly, some people get shares… some don’t. And you’re left thinking: “Did I do something wrong?”

This confusion is very common. Most first-time investors are unsure about how IPO allotment works in India, especially when oversubscription, lotteries, and blocked funds are involved. The good news? The process is rule-based, fair, and simpler than it looks—once explained calmly.

By the end of this guide, you’ll clearly understand how shares are allotted, why non-allotment happens, how to check status, and how to apply with confidence next time.

Understanding how ipo allotment works in india (Core Idea)

Think of an IPO like a limited-seat train ticket during festival season.

Many people apply. Seats are limited. The system must be fair.

In India, IPO allotment is not decided by luck alone, and definitely not by brokers. It follows clear rules set by regulators and exchanges.

Here’s the simple idea:

-

A company offers a fixed number of shares.

-

Investors apply in different categories (Retail, HNI, QIB).

-

If applications are more than shares available, shares are distributed as per rules.

-

Retail investors (like you) often get shares through a computerized lottery, not favoritism.

This entire process is supervised by SEBI and handled through stock exchanges like NSE and BSE.

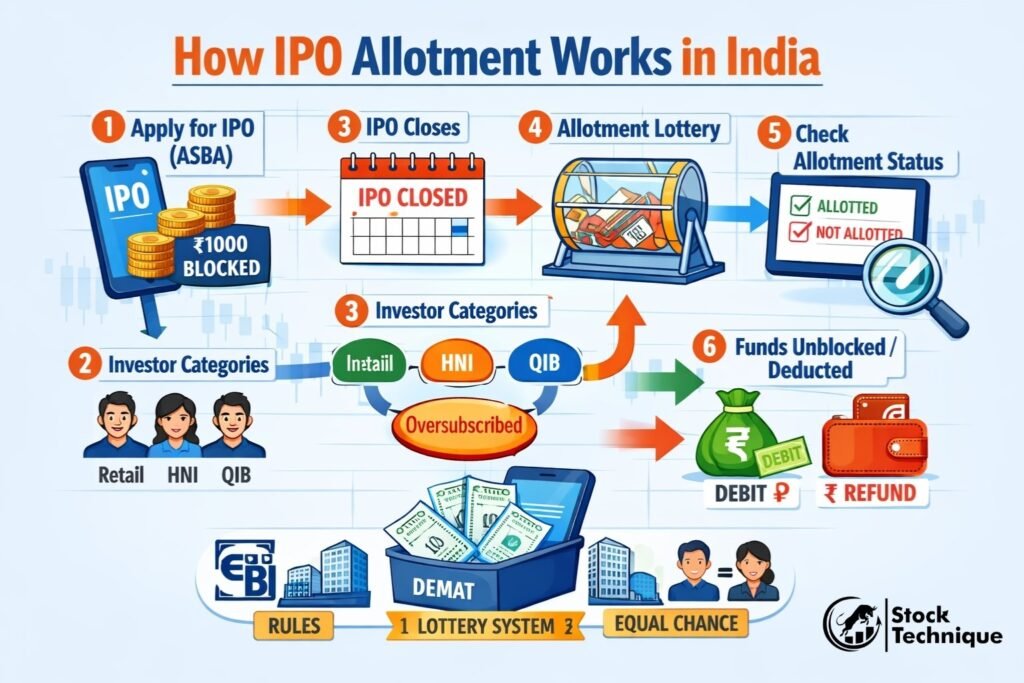

IPO Allotment Process for Beginners: Step-by-Step

Here is the IPO application to allotment steps, explained simply:

-

IPO Opens for Subscription

You apply using your bank or broker app under ASBA. Your money is blocked, not deducted. -

Investors Apply in Categories

-

Retail (up to ₹2 lakh)

-

HNI / NII

-

QIB (institutions)

-

-

IPO Closes

Total demand is checked. This shows whether the IPO is under-subscribed or over-subscribed. -

Basis of Allotment Decided

If oversubscribed, a formula is used. Retail investors usually get minimum 1 lot via lottery. -

IPO Allotment Status Announced

You can check what is IPO allotment status on exchange or registrar websites. -

Funds Unblocked or Deducted

-

If allotted → money deducted

-

If not → full amount unblocked

-

-

Shares Credited to Demat

Shares appear before listing day.

This is how IPO shares are allotted in a clean, digital way.

Important IPO Terms (No Jargon, Just Meaning)

-

Lot Size: Minimum shares you must apply for (e.g., 15 shares).

-

Oversubscription: Demand is higher than shares available.

-

ASBA: Your money stays in bank till allotment.

-

Cut-off Price: Price at which shares are finally allotted.

-

Registrar: Company that manages allotment records (like KFin or Link Intime).

IPO Allotment Rules in India (Retail vs Others)

| Category | Max Investment | Allotment Method | Risk Level |

|---|---|---|---|

| Retail Investor | Up to ₹2 lakh | Lottery if oversubscribed | Low |

| HNI / NII | Above ₹2 lakh | Proportionate | Medium |

| QIB | Institutions | Book-based | Low |

👉 Retail investors are protected the most. You’re not competing with big players directly.

IPO Allotment Calculation Example (₹500–₹1,000 Level)

Let’s say:

-

IPO lot size = 20 shares

-

Price = ₹50

-

One lot cost = ₹1,000

If:

-

1,00,000 lots available

-

5,00,000 retail applications

Then:

-

Each applicant has 1 in 5 chance to get 1 lot

-

Nobody gets extra lots in retail category

This explains reasons for IPO non allotment—it’s demand, not your mistake.

Common Beginner Mistakes (Avoid These Calmly)

-

Applying with multiple PANs (illegal)

-

Cancelling mandate early

-

Applying for IPO without understanding business

-

Thinking “big IPO = guaranteed profit”

-

Checking allotment too early and panicking

Remember: non-allotment is normal, even for experienced investors.

Practical Advice for First-Time IPO Investors

Do This:

-

Apply only via your own bank & PAN

-

Apply at cut-off price

-

Start with 1 lot

-

Learn business basics

Avoid This:

-

Borrowing money

-

Applying blindly due to hype

-

Expecting instant listing gains

Learning first is safer than chasing quick profits.

If you want structured guidance, explore beginner-friendly lessons here:

👉 https://www.stocktechnique.com/courses/

Frequently Asked Questions

1. Why didn’t I get IPO allotment even after applying correctly?

Because retail IPOs are often oversubscribed. Allotment is lottery-based.

2. When is IPO allotment status announced?

Usually 3–4 working days after IPO closes.

3. Is IPO allotment truly random?

Yes, for retail investors. It’s system-driven and regulator-supervised.

4. Can I increase chances of allotment?

Apply in more IPOs—not multiple applications in one IPO.

5. Where can I check official IPO allotment status?

On NSE, BSE, or registrar websites.

Trusted source: https://www.sebi.gov.in/

Conclusion

Once you truly understand how IPO allotment works in India, fear disappears.

You stop blaming yourself. You stop chasing hype. And you start investing with clarity.

IPO investing is not about winning every time—it’s about playing by rules and staying patient.

If you’re serious about learning the stock market step-by-step without pressure, Stock Technique is built exactly for beginners like you.

👉 Start learning safely: https://www.stocktechnique.com/courses/